Growing Homeownership with New Markets Tax Credits

Since 2017, Housing Partnership Network has employed New Markets Tax Credits to advance our members’ work in the field of single-family homeownership. In that time we have:

- Deployed $165MM to 12 HPN Member organizations

- Supported the development of a projected 700+ for-sale homes

Using the model created by our consultant, Smith NMTC Associates, HPN is able to use its New Markets Tax Credit allocation to provide participating members with flexible, low-cost capital to support their homeownership efforts. This capital resource enables our members to build more single-family homes, and offer more affordable mortgages, quality housing stock, and homeownership support services to home buyers with low and moderate incomes and residents of disinvested communities.

Interested in having your project in our pipeline?

Fill out the form to tell us more about your project

Why we use NMTCs

NMTC incentivizes economic and community development - this use stabilizes neighborhoods and enables mixed income communities. HPN utilizes this program in markets with appraisal and affordability gaps in order to provide development subsidy to its members who are building and rehabbing single family, for-sale homes in areas of economic distress.

HPN and its members are uniquely positioned to use New Markets Tax Credits for this purpose thanks to a track record of producing both social and financial returns with similar affordable housing development efforts.

Program Highlights:

- All funds are advanced through a loan at closing and must be spent on the project within 12 months.

- The main qualifier is that homes are built in NMTC qualified census tracts (QCTs) where the tract has either a poverty rate of 20% or greater or median income of 80% or less of that area’s median family income.

- We look to use 70% of our allocation in areas that are severely distressed, primarily with either a poverty rate of 30% or greater or median income of 60% or less of that area’s median family income.

- At the end of the compliance period, through an unwind transaction, participants do not pay back the loan and the portion of the loan funded by the tax credit equity remains in the project. This is what we refer to as the “net benefit”.

- The loan will remain on a member’s balance sheet as debt, even the portion that represents the net benefit, for 7 years. HPN works with members and their auditors on an audit note for that purpose. The “net benefit” is not recognized as revenue until the unwind at the end of the 7 year compliance period. More details on loan mechanics.

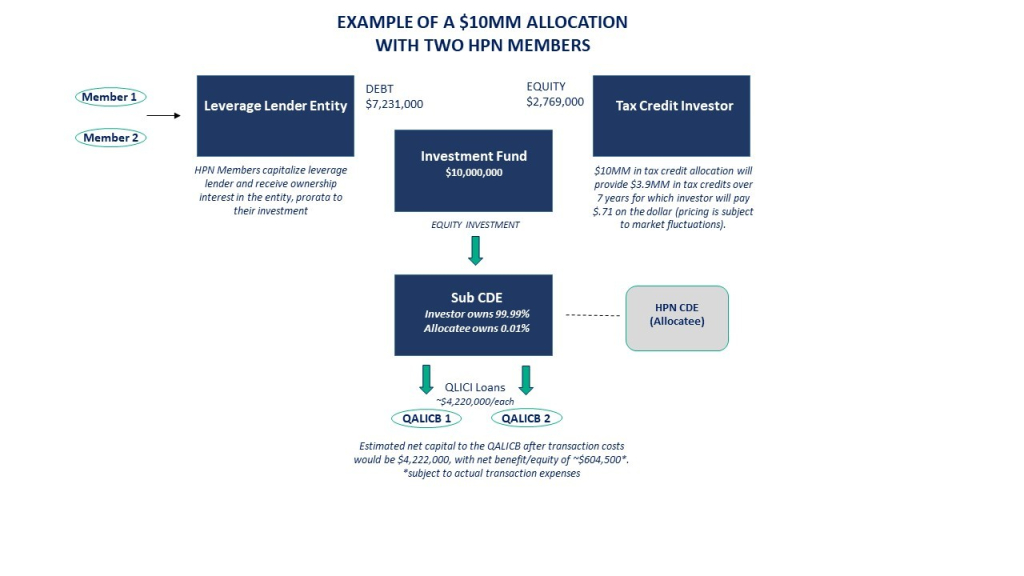

Example of $10MM allocation. Download image

How it works:

- HPN members participating in the NMTC program must capitalize the leverage lender entity. You may do so with cash (either from your balance sheet or borrowed outside of the structure) and expenses incurred on the project up to 24 months prior to closing (these are monetized through a one day equity bridge from the tax credit investor).

- The leverage lender then loans these funds to an Investment Fund owned by the tax credit investor.

- The tax credit investor pays the investment fund in exchange for tax credits (Price paid = allocation amount x 39% credit x market pricing (currently $.70-$.73).

- The Investment Fund then makes an equity investment into a sub-CDE owned by HPN which holds the tax credits, and the Investment Fund becomes the 99.99% owner of the sub-CDE.

- The sub-CDE makes a loan to each participating HPN member.

- Assuming a $10M allocation/loan amount, tax credit market price of 71 cents, and 2 HPN member participants:

- Each participant would receive approximately $4,220,000 to spend on its project.

- At the end of a 7-year compliance period, the transaction would be unwound, and the residual tax credit equity of approximately $604,500 would remain in the project. This $604,500 is referred to as the net benefit.

Any questions? Contact us.